The Strategic Shift: From Vendors to Product Teams

Top CTOs have stopped treating nearshore teams as external vendors and started integrating them as extensions of their product organization. They’re looking for aligned, real-time collaborators who can contribute to business outcomes, not just execute tickets. The focus has moved from rate arbitrage to speed, predictability, and genuine product alignment.

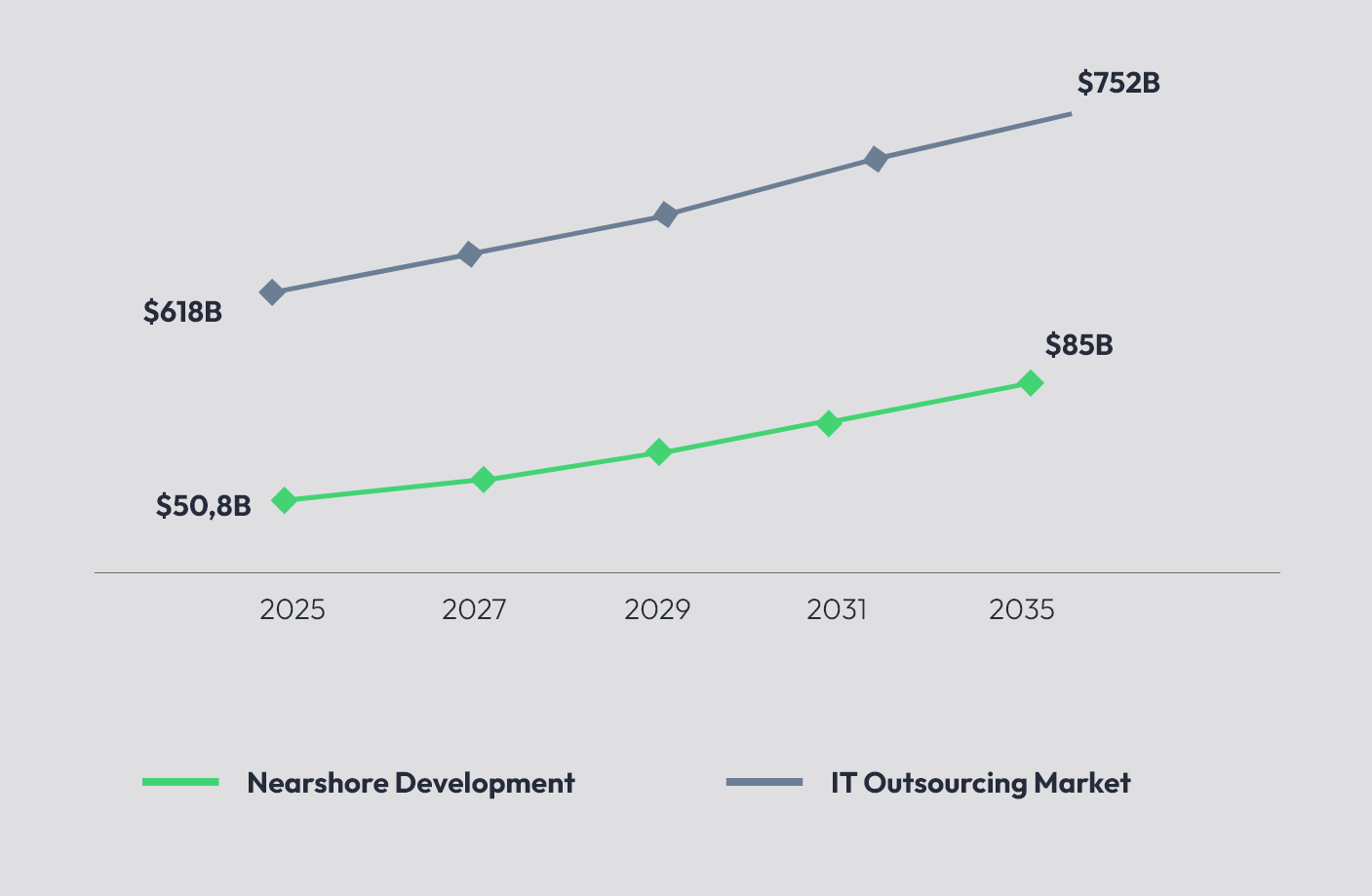

This shift comes at a pivotal moment. The IT outsourcing market, valued at $618.13 billion in 2025, is projected to reach $752.08 billion by 2031, according to ResearchAndMarkets.com. Within this broader market, nearshore software development services are experiencing explosive growth, expanding from $50.8 billion in 2025 to an estimated $85 billion by 2035, with a compound annual growth rate of 5.2%, as reported by eSparkBiz. More significantly, nearshoring is capturing market share from traditional offshore models, with Hire With Near projecting nearshore contributing $78 billion to Latin American exports alone.

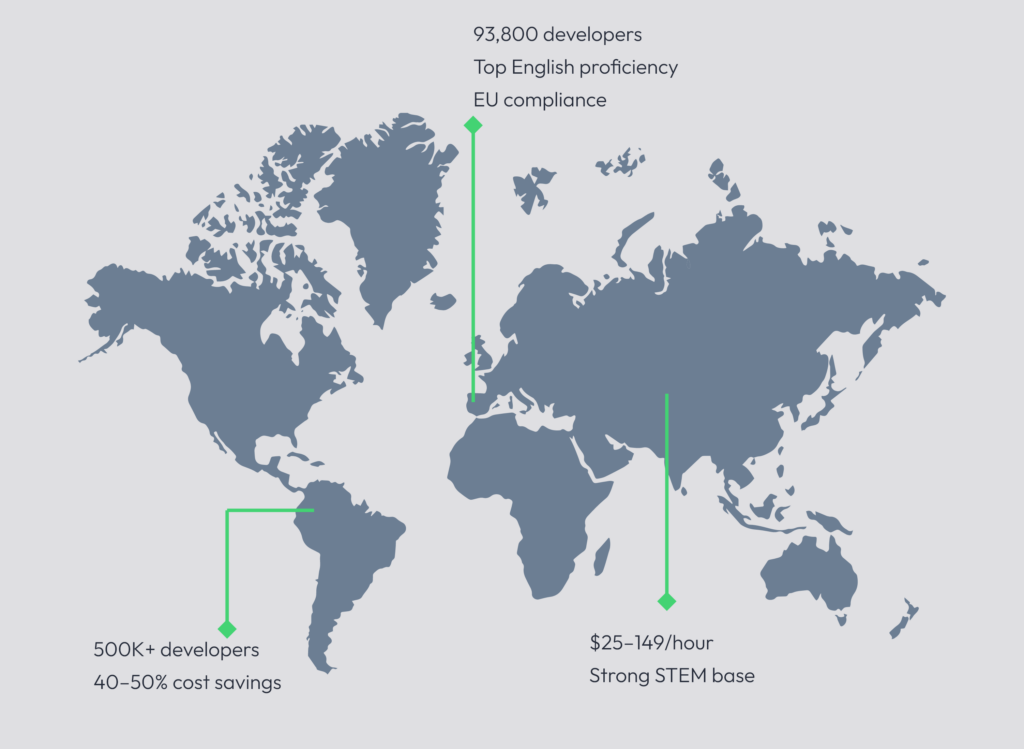

Geographic hubs are consolidating around key regions. Latin America is home to over 500,000 software developers, with Brazil contributing approximately 500,000, Mexico 220,000, Argentina 115,000, and Colombia 62,000. These markets offer 40-50% cost savings combined with overlapping time zones for US companies. By 2026, approximately 80% of North American companies are exploring or actively using nearshore development teams from this region.

Eastern Europe provides similarly strong technical depth, with average hourly rates of $25-149 compared to Western European rates of $50-199. Poland, Ukraine, and Romania have become established hubs thanks to comprehensive STEM education systems and a reliable work ethic.

Portugal has emerged as a strategic European nearshore destination. According to Statista, the country’s software development market is projected to reach $3.62 billion by 2029, growing at a CAGR of 5.35% from 2024 to 2029. Portugal is home to approximately 93,800 professional developers, with the country producing 90,000 STEM graduates annually, placing it among the top three in Europe for engineering graduate output. The IT market in Portugal has grown 133% over the last decade compared to other nearshoring locations, per emagine research.

Portugal’s appeal extends beyond cost. Ranked 7th globally for English proficiency according to the EF Proficiency Index, and positioned in the GMT/GMT+1 time zone, it offers seamless real-time collaboration with Western European and North American markets. The country ranks 6th in the 2024 Global Peace Index and 8th in Europe for cybersecurity per the Global Cybersecurity Index, providing political and operational stability that reduces risk. Global companies including Microsoft, Google, Nokia, Siemens, and SAP have established nearshore operations in Portugal.

Remote developers in Portugal command an average salary of $61,608 annually (approximately $50,500 for mid-level developers) according to Arc and Qubit Labs, offering significant cost advantages versus Western European markets while maintaining quality standards on par with top-tier locations. Portugal’s IT outsourcing market was valued at $824.6 million in 2025, powered by tech ecosystems in Lisbon, Porto, and Braga.

The business case is compelling across all these regions. In 2025, large enterprises accounted for approximately 59.4% of the global offshore and nearshore development market share according to Cognitive Market Research, increasingly prioritizing these partnerships to accelerate product launches and boost organizational agility. North America dominates the outsourcing market with a 24.12% share and $46.2 billion in revenues in 2023, per ResearchAndMarkets.com.

From Cost Center to Core Delivery Model

The most sophisticated CTOs position nearshore as a primary delivery model for complex digital programs. They’re designing “embedded pods” or outcome-based squads that own features or domains end-to-end. These teams aren’t task executors. They’re product builders with clear accountability.

This approach requires rethinking vendor relationships entirely. Instead of treating nearshore partners as ticket factories, successful CTOs structure engagements around outcomes. Teams own entire feature sets, participate in product decisions, and carry responsibility for what they build from conception through production.

Nearshore developers offer a 46% lower hourly rate compared to onshore teams on average according to Hatchworks’ 2025 nearshore statistics, but the value proposition extends far beyond cost. Mexican nearshore centers are enhancing DevOps capabilities for US clients according to ResearchAndMarkets.com, while Portuguese firms provide EU-aligned compliance frameworks and cultural compatibility for European organizations seeking both cost efficiency and operational alignment.

The New Due Diligence Checklist

What separates good nearshore partners from great ones? Top CTOs have developed structured evaluation criteria that go far beyond reviewing portfolios and checking references.

Technical fundamentals are mandatory. Strong technical depth, documented architecture decisions, and mature DevOps practices (CI/CD pipelines, test automation, SRE protocols) are table stakes, not differentiators. If a partner doesn’t have these foundations in place, the conversation doesn’t advance. In 2026, infrastructure outsourcing led the market with 45.05% share due to demand for resilient operations, according to ResearchAndMarkets.com, while application development and maintenance continue evolving with low-code and AI-driven methods.

Cultural fit matters as much as technical fit. CTOs assess communication rhythm, collaboration style, and how potential team leads actually work. Structured due-diligence checklists and non-business-critical trial projects reveal whether teams can truly integrate. Can they challenge assumptions constructively? Do they communicate proactively? Will they mesh with your existing culture? This evaluation becomes more critical as 21% of small businesses in 2022 moved to nearshore companies, up from 15% in 2021, according to eSparkBiz.

The team leads matter more than the company. Many CTOs now insist on meeting and vetting the actual leads who will work with their teams, not just company executives. They want to understand who will be in the daily standups, code reviews, and architecture discussions. The emphasis has shifted to validating specific people, not just company capabilities.

2026 Table Stakes: AI, Security, and Compliance

The landscape has evolved rapidly. What seemed cutting-edge two years ago is now expected.

AI-enabled collaboration is becoming standard. Nearshore relationships increasingly rely on AI tools for code review, documentation generation, and QA to cut onboarding time and reduce handoff friction. The data is striking: 84% of developers already use or plan to use AI tools in their workflow according to Index.dev, with 82% using AI coding assistants daily or weekly per Second Talent research. In 2025, 41% of all code is AI-generated or AI-assisted according to GitHub’s Octoverse and Netcorp analysis, representing a fundamental shift in how software gets built.

Partners who aren’t leveraging AI to streamline collaboration are falling behind. AI coding tools help developers write code 55% faster according to Second Talent, complete code reviews 15% faster per Index.dev data, and reduce time spent searching technical documentation by 62% according to the same source. For nearshore teams, this translates to faster onboarding (developers save 30-60% of time on coding, testing, and documentation per Netcorp research) and reduced handoff friction between distributed teams.

However, quality control remains essential. Only 30% of AI-suggested code gets accepted by developers according to Netcorp, and 48% of AI-generated code contains security vulnerabilities per Second Talent research. The best nearshore partners have implemented robust review processes. Teams using AI code review tools see quality improvements jump to 81%, compared to 55% for teams achieving similar speed without AI review, according to Qodo’s State of AI Code Quality report.

Security isn’t negotiable. Zero-trust security frameworks, standardized SRE practices, clear data-residency options, and GDPR/CCPA-ready contracts are now baseline requirements in serious nearshore deals. CTOs won’t compromise on security posture, regardless of cost savings. The cybersecurity talent gap of 4.8 million positions according to ResearchAndMarkets.com is driving demand for managed detection and response services, making security expertise a key differentiator for nearshore partners.

Escalating IP-theft and ransomware incidents have led to increased insurance premiums and limited coverage. Buyers now demand that providers carry higher insurance limits and undergo regular penetration tests. This pressure is driving industry consolidation and raising the bar for smaller vendors.

Compliance is built in, not bolted on. The best partners understand regional compliance requirements and data governance standards before the CTO has to explain them. They’ve structured their operations to support multiple compliance frameworks without custom engineering for each client. Data privacy regulations like GDPR and CCPA significantly influence service offerings and contractual agreements, requiring robust data security measures from day one.

How Success Gets Measured: The Metrics That Matter

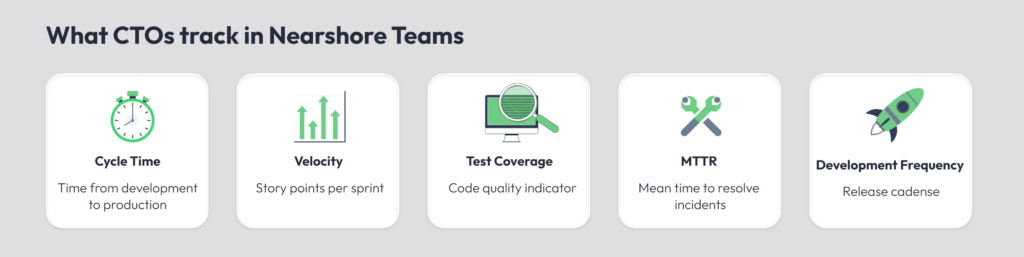

Top CTOs track nearshore teams with the same rigor they apply to internal teams. They measure cycle time, sprint velocity, defect trends, test coverage, and production incident rates. If nearshore performance doesn’t compare favorably to internal benchmarks, something needs to change.

Cycle time and velocity are primary indicators. Cycle time measures the duration from when work begins on an item until it’s fully deployed, revealing process efficiency and bottlenecks according to DevCrew’s software development metrics guide. Teams monitoring cycle time can achieve predictable software processes that are easier to control and lead to reliable project predictions. Velocity, measured in story points completed per sprint, helps CTOs predict capacity and forecast how much work nearshore teams can handle in future sprints, per Atlassian’s agile metrics documentation.

Modern engineering teams track these metrics in real time using integrated platforms. Tools like Jira, Azure DevOps, and Linear visualize sprint velocity, cycle time, throughput, and story point completion. The most sophisticated CTOs combine DORA (DevOps Research and Assessment) metrics, which measure deployment frequency and change lead time, with SPACE framework indicators that capture satisfaction, performance, activity, communication, and efficiency, as outlined by Cortex.

Quality metrics are non-negotiable. Beyond speed, CTOs track test coverage, defect density, production incident rates, and mean time to resolution (MTTR). They monitor pull request review times, as long review times kill momentum and increase merge conflicts. They track CI/CD pipeline duration, recognizing that if tests and builds take 45 minutes, developers lose flow and productivity suffers.

The benchmark is internal teams, not other vendors. This data-driven approach serves two purposes. It identifies problems early, before they compound. And it provides objective evidence when nearshore teams are performing well, making it easier to expand their responsibilities and deepen the partnership. Teams that measure these metrics properly understand that high velocity means nothing if cycle time keeps growing or quality drops, according to Atlassian.

Planning for Evolution and Exit

The best CTO relationships plan for both growth and separation from day one. As nearshore partners gain context and prove themselves, their responsibilities should expand naturally. But this growth happens within clear boundaries.

Code ownership stays clean. Documentation quality remains high. Tooling stays vendor-agnostic. These practices aren’t about distrust. They’re about maintaining optionality. If you need to transition work to another partner or bring it in-house, you should be able to do so without a complete rewrite.

This approach becomes even more critical as geopolitical tensions drive enterprises to diversify sourcing, balancing offshore, nearshore, and onshore centers to mitigate risk. The software development outsourcing market is projected to reach between $564 billion and $897 billion by 2030, and CTOs who maintain clean separation and documented processes position themselves to adapt as the landscape shifts.

The Bottom Line

Nearshoring in 2026 isn’t about finding cheaper developers. It’s about building distributed product teams that can move fast, deliver consistently, and scale intelligently. The CTOs who treat it that way (with the same rigor they apply to internal hiring, team structure, and engineering practices) are building competitive advantages that extend far beyond cost savings.

The nearshore partner you choose should make your engineering organization stronger, not just larger. In 2026, that’s not aspirational. It’s the standard. With 80% of executives planning to maintain or increase investment in third-party outsourcing, and the market experiencing double-digit nearshore growth versus traditional offshoring, the competitive pressure to get this right has never been higher.

The data tells a clear story: nearshoring is no longer a cost lever. It’s a capacity and specialization strategy for long-term growth. The CTOs who understand this and build their nearshore partnerships accordingly are the ones who will thrive.

Ready to Build a Nearshore Team That Actually Integrates?

At XpertSoft, we provide nearshore software development services from Lisbon, combining European time zone alignment, GDPR-native compliance, and senior engineering talent with the strategic approach top CTOs demand in 2026.

We don’t build ticket factories. We build embedded product teams with mature DevOps practices, documented architecture decisions, AI-enabled collaboration workflows, and the cultural compatibility that makes real collaboration possible.

Let’s talk about how nearshore should work. Contact us to discuss your product engineering challenges and explore whether we’re the right fit for your team.